To win big in Tanzania, brands in the financial sector should customize their loan offerings.

- Paul Cheloti Mulongo

- Jul 14, 2023

- 2 min read

Updated: Sep 14, 2023

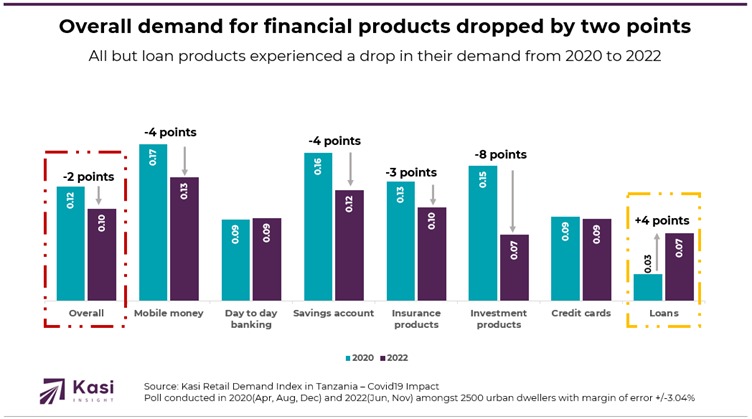

According to Kasi Insight, the overall demand for financial products in Tanzania declined by 2 points after the pandemic. This decrease can be primarily attributed to a significant slump of 8 points in the demand for investment products. There were also decreases of 4 points in the demand for mobile money, savings accounts, and 3 points in the demand for insurance products. However, the demand for loan products increased by 4 points, while the demand for day-to-day banking and credit cards remained consistent.

These figures are based on Kasi Insight’s Retail Demand Index, which measures consumer demand for retail category and provides insights on how consumer habits impacted demand for various categories. The index ranges from + 0.25 to -0.25. An index level close to 0.25 means demand is high as more consumers are looking to purchase while an index level close to -0.25 means demand is low.

All but Gen Zers taking up loans in Tanzania.

The demand for loan products witnessed an overall increase of four points. Based on segments, it was observed that millennials and males displayed a significant five-point increment in demand from 2020 to 2022. Similarly, females exhibited a three-point increase, while Gen Xers had a two-point increase. However, Gen Zers bucked the trend of increasing demand for loan products, experiencing a one-point drop in demand during the same period.

The increase in demand for loan products can be primarily attributed to the financial hardship faced by a significant portion of Tanzanians in 2022. Approximately 60% of respondents surveyed found it difficult to make money, leading them to seek out alternative means of obtaining money, resulting in a surge in the demand for loans. Additionally, the year 2022 witnessed high inflationary pressures, with the highest rates recorded in October at 4.9%. These tough economic conditions further exacerbated individuals’ financial situations, driving them to seek loans as a means of coping with rising prices and fulfilling their financial obligations.

There is a need for financial brands to reassess their strategies based on consumer demand patterns.

The overall decline in demand for financial products following the pandemic, particularly the significant slump in investment products, suggests a need for brands to reassess their strategies in this area. It may be necessary to identify and address the factors that have led to decreased interest in investment products, such as market volatility or changing consumer preferences.

The decrease in demand for mobile money, savings accounts, and insurance products also highlights a shift in consumer behavior. Brands should investigate the reasons behind these decreases and consider adjusting their offerings, pricing, or communication strategies to better align with consumer needs and preferences.

On the positive side, the increase in demand for loan products presents an opportunity for financial brands to focus on this segment. Understanding the specific needs and preferences of different consumer segments, such as millennials, males, females, and Gen Xers, can help tailor loan products and marketing efforts to effectively reach and engage these target audiences.

Contact our team today to explore how our consumer intelligence can empower your decision-making process. Win with confidence with Kasi insights https://www.kasiinsight.com/thehub

Comments