Navigating Inflation in Tanzania and 3 Opportunities for Alcoholic Beverage Producers

- Jun 2, 2023

- 3 min read

Updated: Sep 14, 2023

The World Bank’s March 2023 report indicates that Tanzania’s recovery from the COVID pandemic has been positive. GDP figures at the end of 2022 showed 0.3% growth, up from 4.3% in 2021.

While these figures show progression, is the everyday man’s experience different?

We took to the streets to survey Tanzanians. Our sample size of 1493 participants across three periods -- June 2022, November 2022, and March 2023 -- shows precisely the impact of inflation.

What follows is a look at how Tanzanians are managing the effects of inflation with particular attention to 3 opportunities alcohol brands can leverage to stay competitive.

Here’s what we found:

Household income is expected to increase

When asked how household income is expected to change in the next 6-month period, Tanzanians have been more positive about experiencing increases.

While we saw fewer households think they would earn more between March 2022 (52.03%) and November 2023 (44.62%), March 2023 showed an uptick with 57.72% of households believing they would generate more income.

Utility prices are skyrocketing

Utilities continue to increase with an average of over 70% of respondents stating the prices for water, electricity, gas, and other utilities have increased or risen substantially.

Most people are uncertain about affording essentials

Affording regular expenses hasn’t been too much of a struggle for some while it remains largely unclear for most. Over our three-period window, 59.54% of Tanzanians shared that they might be able to afford daily essentials, compared to 2.88% who can’t, and 37.58% who can.

We noticed that while more people are uncertain about affording essentials, that figure has dropped from 67.93% in November 2022 to 54.11% in March 2023 showing an improvement in financial prosperity.

Lower demand for large purchases

Fewer respondents have shown an interest in making large furniture and electrical appliances purchases since the increase in inflation.

Just over a third of our pool was likely to make new purchases in June 2022, in November 2022 that number dropped to 18.73%, and further to 14.23% in March 2023 -- all due to uncertainty spurred on by the economic climate.

Frequent borrowing slowly decreasing

The pandemic produced a tough economic climate for the world, and Tanzania, while presenting a positive GDP at the end of 2022, was no different. Many had to borrow to meet day-to-day expenses. Of our pool of respondents, 79% borrowed money a few times or frequently to meet day-to-day expenses.

How Tanzanians have been fighting inflation

Buying habits have had to adjust in light of a higher cost of living. Here are some of the ways Tanzanians have responded to rising inflation:

● 21% are buying meat less often, cutting back on takeout, spending less on recreation and leisure, and opting to repair or buy second-hand items instead of buying new

● 17% have delayed the purchase of non-essentials

● 17% are buying cheaper alternatives, brands or items

● 11% are actively seeking out sales and promotions

● 11% have reduced daily costs by sharing vehicles to save on fuel

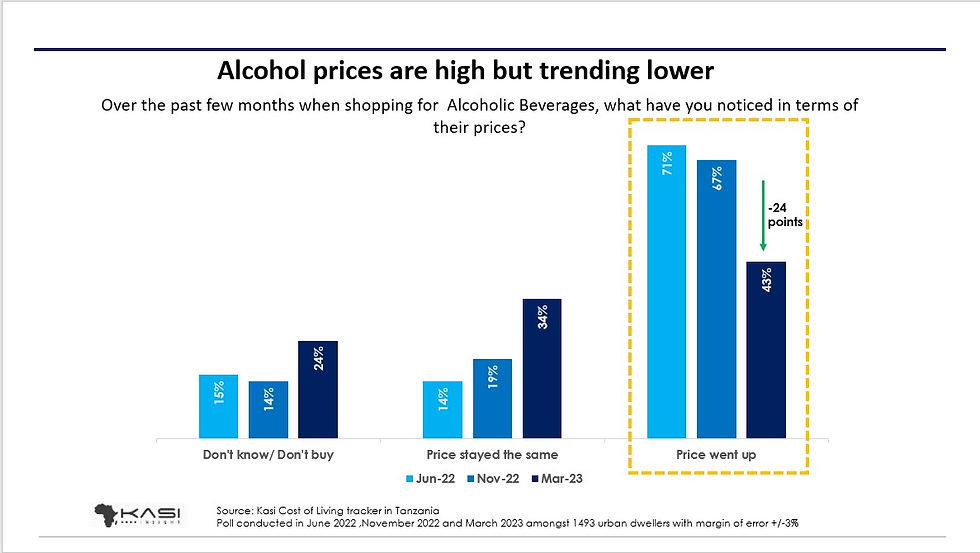

Spotlight on Alcohol: Prices are high but trending lower

While Tanzanians have noticed an increase in the cost of alcohol, trends show that sentiment for higher prices has been decreasing since June 2022. In a way, there’s been a slight adjustment of sorts to higher prices, but not one that should easily be shrugged off.

Any amount of positive sentiment is welcome, however, Tanzanians maintain a high awareness of higher prices that can be addressed in several ways -- all tied to product awareness and usage.

Here are three ways brands can tackle higher price sentiment:

1. Revisiting promotion strategies and ad placements

Tanzania’s population of over 58 million people has a smartphone penetration of 73.7% among the age group of 25-34 years old. This presents brands with an opportunity to create social media campaigns through platforms like YouTube which offer policies that allow targeting this demographic.

2. Investigate packaging and pricing alternatives

An increase in pricing sentiment can be offset in two ways. First, the brands can offer competitive pricing as part of special limited offers, or possibly bulk deals. Second, producing packaging options that are aligned with lower pricing, such as smaller bottles for beer or spirits at more attractive price points.

3. A shift or refocus in brand strategy and positioning

Alcohol is considered a luxury good, adding to its easy alignment of specific status symbols. Considering the effects of higher prices in Tanzania, there is an opportunity to build greater brand affinity through smart strategy, positioning, and promotion. Identifying brands with specific lifestyles and lifestyle choices could help cultivate greater brand awareness and loyalty.

Most believe that things will improve

When asked if the general economic conditions will change in Tanzania, we noted an overall positive sentiment from June 2022 to March 2023. Averages show that 55.06% of respondents believe the economy will improve, 41.26% feel it will stay the same, and 3.68% foresee it worsening.

Contact our team today to explore how our consumer intelligence can empower your decision-making process. Win with confidence with Kasi insights https://www.kasiinsight.com/thehub

Comments