Consumer sentiment steadies in September

- Sandra Beldine Otieno

- Oct 20, 2023

- 4 min read

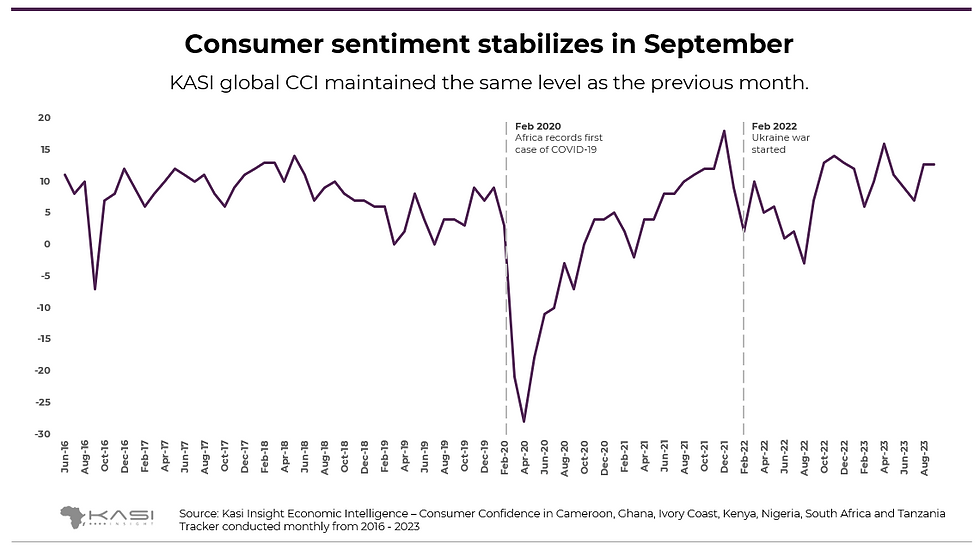

In September, consumer confidence in Africa held steady at 13 points. This stability was driven by a two-point uptick in the current conditions index and a one-point dip in the future conditions index.

In September, household indices displayed mixed performance. The personal finance index and household spending index both made significant gains, each increasing by 4 points. On the other hand, the discretionary spending index showed an even more remarkable improvement, rising by 6 points. In contrast, the household income index dipped by four points, and the job prospect index slipped by a single point. Additionally, both the general country economic conditions index and the general city economic conditions index saw declines, dropping by 5 and 3 points, respectively.

Among the countries we monitor in our index, consumer sentiment took a hit in four of them: Cameroon, Kenya, Nigeria, and Tanzania. Conversely, Ghana, Ivory Coast, and South Africa, the other countries in our tracking, saw an upswing in sentiment. Nigeria experienced the most pronounced decline, with a 6-point drop, while Ghana outshone the rest, recording an increase of 7 points.

In September, consumer confidence remained firm at 13 points, mirroring the August figure. This constancy was influenced by a two-point uptick in the current conditions index, counterbalanced by a one-point decline in the future conditions index.

Household indices present a complex economic landscape with mixed signals

In September, household indices presented a mixed picture compared to August, highlighting the ongoing challenges posed by rising living costs. Of particular significance were the declines in both the country economic conditions and city economic conditions indices, signifying a growing sense of economic instability and reduced confidence within these regions during the period.

The personal finance and household spending indices posted gains, each surging by 4 points. These increases suggest that consumers are experiencing a heightened sense of financial security, potentially driven by factors like increased income, reduced expenditures, or improved financial management. The discretionary spending index showed an even more remarkable improvement, rising by 6 points, indicating growing consumer confidence and a greater willingness to invest in non-essential items. Conversely, the household income index dipped by four points, pointing to a potential decrease in household earnings, likely attributed to factors such as job losses, reduced working hours, or economic challenges. Additionally, the job prospect index slipped by a single point, suggesting a slightly less positive outlook on employment opportunities, potentially reflecting growing job market uncertainty and job security concerns.

Rising inflation in Nigeria tempers consumer sentiment, while Ghana's forward-looking economic reforms pave the way for renewed consumer confidence

In the countries tracked, consumer sentiment experienced divergent trends. Ghana saw a 7-point surge, reflecting growing consumer confidence. In contrast, Nigeria witnessed a substantial 6-point decline, signaling a dip in consumer confidence.

In Ghana, consumer sentiment experienced a 7-point increment, driven by 15-point increases in personal finance, discretionary spending and household spending indices. This boost in consumer sentiment can be attributed to the positive outcomes of economic reform programs supported by the International Monetary Fund (IMF). These reforms, implemented in the first four months, have yielded positive results. The country witnessed strong economic growth in the first and second quarters, along with exchange rate stability and decreasing inflation, all of which indicate successful program implementation. The Ghanaian economy expanded by 3.2% in Q2, following a 3.3% growth in Q1, surpassing the IMF’s 1.5% growth target. Additionally, the central bank’s confidence survey reflects improving sentiments among consumers and businesses, expected to persist throughout the year in alignment with enhanced macroeconomic conditions.

Nigeria’s consumer sentiment declined by 6 points with the index of current conditions dropping by 12 points. The decline in consumer sentiment in Nigeria can be largely attributed to the concerning surge in the inflation rate for the month of September 2023. As reported by the National Bureau of Statistics (NBS), the inflation rate escalated to 26.72 percent, marking a significant 0.92 percent increase from the preceding month's rate, which stood at 25.80 percent in August. One of the most noticeable effects is the persistent and steep increase in the prices of essential foodstuffs and goods. Consumers have been grappling with the burden of ever-mounting costs, which have eroded their purchasing power and led to a general sense of financial insecurity.

As the holiday season approaches, consumer confidence in Africa has shown resilience in September, though household indices present a nuanced and mixed picture

For value brands, the stability in consumer confidence suggests that there is a segment of the population with consistent purchasing power. The rise in personal finance and household spending indices by 4 points each indicates that consumers are feeling more financially secure and may be willing to allocate their budgets to essential items. This is a positive sign for value brands, as consumers might prioritize affordability and practicality in their holiday purchases. On the other hand, the dip in the future conditions index and the decrease in the job prospect index may raise concerns for value brands. Consumers may become more cautious about their financial future and, with slight job market uncertainty, could be inclined to save and cut back on discretionary spending, potentially impacting premium brand sales.

For premium brands, the increase in the discretionary spending index by 6 points is a promising sign. It indicates that consumers are becoming more confident and willing to invest in non-essential items, which could benefit premium brands. However, it’s essential for premium brands to emphasize the value and quality of their products to cater to consumers looking for more upscale options. Value and premium brands should also pay close attention to country-specific trends. Countries with declining consumer sentiment might require different marketing strategies than those with improving sentiment.

Contact our team today to explore how our economic intelligence can empower your decision-making process. Win with confidence with Kasi insights https://www.kasiinsight.com/thehub

Share on socials using this caption: 📈 Steady consumer sentiment in September, 🚀 Ghana's 7-point boost due to IMF-supported reforms, 📉 Nigeria's 6-point dip amidst inflation surges. Value and premium brands, brace for a diverse holiday season. #ConsumerInsights #HolidaySeason #AfricaMarket #EconomicReforms #InflationImpact #ShoppingTrends 🛍️🌟

Comments